COVID-19 Startup Impact Report

A data snapshot of how Australian startups are coping with COVID-19 and the types of support they need.

Innovation Bay’s mission is to support startup founders on their journey from idea to IPO and beyond. In the wake of COVID-19, we’ve amended how we deliver value to our community; the past few weeks, we’ve hosted weekly virtual panel events featuring leaders within the Australian startup ecosystem. If you missed them check out recordings of the VC and founders panels.

In addition to virtual events, we also circulated a Startup Impact Survey to capture a snapshot of how startups are responding to COVID-19. We received over 100 survey responses and this report combines the survey data with insights we gained from expert panellists. Our findings are bucketed into four themes:

1) Business Impacts, 2) Fundraising, 3) Government Support, and 4) Working from Home. Before we dive into the report, let’s take a look at who’s represented in the data:

1. Business Impacts

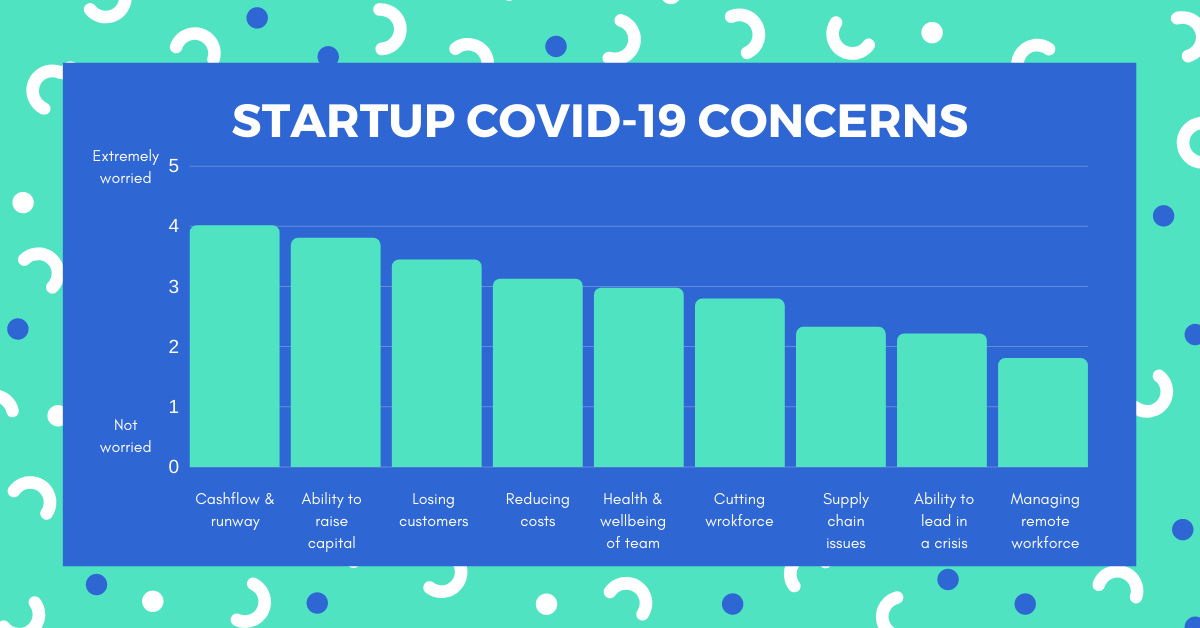

Top Concerns

Cashflow & runway, ability to raise capital, and losing customers are the top three concerns for Aussie startups facing COVID-19.

Revenue

More than half of startups expect to experience dips in revenues over the next 12 months. Another 29.4% are unsure of what the eventual impact on revenue will be over the next year, speaking to the high level of uncertainty startups are currently operating under.

Planning for Uncertainty

“You’ve got to plan for the worst and hope for the best.”

– Kate Morris, Co-founder & CEO of Adore Beauty

Our investor and founder panellists shared some advice about how to adjust your business plan in the face of uncertainty.

Didier Elzinga, Founder & CEO of Culture Amp has established a daily situation room that works through how the team is tracking and adapting to the crisis. A team of 30 gathers virtually every day in a communal spreadsheet for a half-hour to analyse evolving external data, internal data, comms, and decide which projects need to be spun up in response.

Luke Anear, Founder & CEO of SafetyCulture is considering a wide range of scenarios saying, “I think of the worst-case scenario and work through that, and then think of the best-case scenario and work through that. If I can deal with the worst case I can deal with anything towards the best case.”

Rick Baker from Blackbird echoes this point saying “Look at scenarios that push your runway out further than makes you feel comfortable. Plan someway if possible to push that runway out towards 2 years rather than 1 year.”

Conserving Cash

“You only run out of cash once in a business.”

– Ian Gardiner, Innovation Bay

With regards to conserving cash, our panellists all had different recommendations for staying lean throughout the COVID-19 crisis:

Kate Morris, Co-founder & CEO of Adore Beauty has put a freeze on a big planned round of hiring.

Dr Michelle Deaker, Managing Partner at OneVentures suggested considering reducing the number of workdays in a week to retain existing talent while slowing cash burn.

Bridget Louden, Founder & CEO of Expert360 says, “Your dollar on the other side of this goes so far. If you can conserve as much cash as possible during this time, then you have to do that.” To cut costs, Bridget renegotiated 3–6 months free rent for her business.

Craig Blair, Airtree Ventures recommends looking for alternative sources of cash. He says, “How much can you sure up the balance sheet? It may not be VC money, but it could be government stimulus, it could be bringing forward R&D Tax Credits. Whatever you can do to get your hands on some cash to (strengthen) your balance sheet.”

Paul Bassat, Square Peg Capital cautions against wasteful spending. He says, “A dollar spent on something unnecessary today is not a dollar you can get back unless you’re able to raise capital.”

2. Fundraising

Impact on Fundraising

Our survey data shows that most startups believe that COVID-19 will make it much harder to raise funds over the next 12 months. Craig Blair from AirTree gave us a good overview of how COVID-19 will impact the startup investment climate:

“I think we’re going to see non-traditional funders pull out of the market. Corporate venture capital firms, family offices, private equity, hedge funds, are already retreating back to their core investment area. You’re going to see existing funds divert capital to support their current portfolio, which is obviously the right thing to do. There’s no question that you’re going to see funding decline…Rounds are going to be delayed and deferred. It’s all about extending runway and buying time so you can come out the other side of this crisis”

Guidance from Investors

For startup respondents that had investors, just over half have received investor guidance regarding how to respond to COVID-19. Our investor panellists shared some pearls of wisdom for startups coping with the crisis.

Paul Bassat from Square Peg Capital advice for entrepreneurs: “All entrepreneurs are pathologically optimists. really, really try to temper your natural optimistic tendencies. It’s not all doom and gloom but don’t assume that in a month’s time we’re all going to move back to the world as it was because that’s highly unlikely.”

Dr Michelle Deaker from OneVentures advice for startups with big R&D expenditure: “Focus on the core things that are absolutely necessary to create the biggest value inflection points in your business down the track. So if you’ve got R&D programs across a number of different areas, just say ‘What is the one thing, or two maybe, that are going to give me the biggest ROI?’ and focus on that. And in then you work out what cash you require for that. In terms of cash runway, we’re telling everyone to try and work out how this is going to be two years.”

Craig Blair from Airtree Ventures: “Now is the time to really ask the hard questions about which part of your product is the killer app and which part is a swiss army knife.”

3. Government Support

“Don’t let all the momentum the startup ecosystem has built over the last few years be lost and set back by withdrawing support now. Now is the time to inject more stimulus. The right investment in the startup ecosystem (accelerators, tax incentives) will yield benefits for years to come.”

Wage relief and tax relief or incentive programs are the most requested forms of government support from the survey, with 57% and 55% respectively of respondents expecting that these initiatives would help their companies cope with COVID-19.

4. Working from Home

“As a leader, I worry about the spread of generalised anxiety in my staff. How do I manage this, especially when my staff are dealing with homeschooling, ageing parents etc.”

Remote Working Tools

Zoom and Slack are the most widely used remote working tools in #startupaus, with 65.7% and 64.7% of respondents respectively employing the two tools. Some other popular tools that weren’t included in the survey, but raised by respondents were Notion and Tandem. We featured these two apps in our productivity tools post earlier this year.

Ways to Engage Teams

The startup ecosystem has found innovative ways to maintain human connection and company culture throughout this challenging period, with many startups implementing new company-wide routines and rituals.

Our founder panellists shared a few additional initiatives, not covered in the survey:

- Daily CEO videos. Didier Elzinga of Culture Amp is recording and circulating videos daily for his company. He speaks about what’s on his mind and what plans are in the works. Sharing these human moments and communicating consistently helps his company remain connected and informed.

- Team exercise. Bridget Louden of Expert360 has a former PT on her team that is leading company-wide workouts every Wednesday. Even if you don’t have trained experts on staff, group remote exercise sessions are a great way to socialise and stay fit.

Staying Healthy

With regards to COVID-19’s impact on mental wellbeing, most people working in startups are affected by the crisis. On a scale of 1–5, 1 being no impact, 5 being extremely anxious, respondents recorded an average of 3.3.

Startups are staying healthy throughout the crisis in a number of ways. Some additional responses added by respondents include hobbies, fun family activities, art, gratitude practice, virtual yoga, and drinking lots of water.

Looking on the bright side

To end on a positive note, our panellists reminded us that this crisis can be framed as an opportunity for businesses to shift or improve their value proposition.

Paul Bassat from Square Peg Capital: “The one thing Australian companies over the last 10–15 years have had to be unbelievably good at is building incredible businesses with capital scarcity…Let’s use this as an opportunity to build the next generation of Australian technology companies.”

Craig Blair from Airtree: “Nothing spawns creativity more than scarcity.”

Rick Baker from Blackbird Ventures: “On the positive side…a lot of the really great companies were either founded or in the early parts of their lives during a big downturn. Paypal, Google, Facebook, in or after the dotcom crash. Uber, Airbnb, Square, Stripe, out of the GFC. Why? There’s less competition, there’s less noise, there’s less competition for talent and for digital marketing, there’s larger companies pulling back to their core products. What does it mean? It means survive at all costs. Survival is often not just the best companies, it’s those that adapt best to a situation.”